After I browse the net or social media, guides on learn how to grow to be a millionaire pop up in all places.

In the event you learn them, you’ll rapidly discover out that they’re crammed with the identical fluff. Let’s name it “slow-lane pondering” after DeMarco’s in style ebook.

Most of these guides assume you’ve 4 a long time of diligent financial savings left.

However even should you do, are you actually impressed by the thought of reaching millionaire standing with 65? Is it attainable to succeed in it means earlier?

On this information, we’ll have a look at the maths of all of it. So, let’s get began!

You possibly can observe alongside by trying out the Google spreadsheets right here:

Base Technique

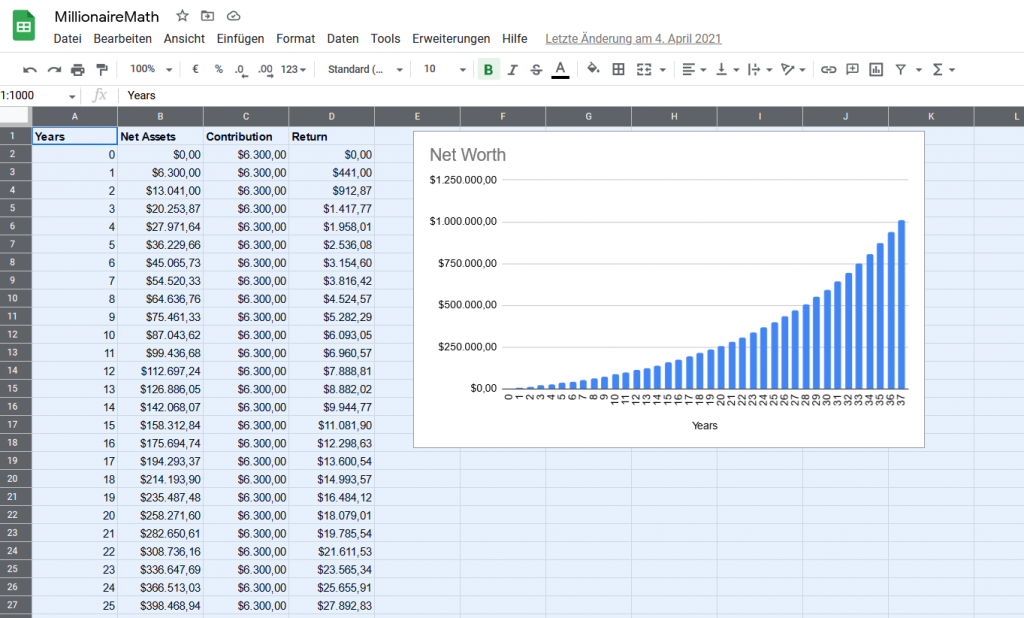

So, right here’s the slow-lane technique that’s sound and can make you a millionaire should you stay lengthy sufficient and also you or the market don’t mess it up:

- Work as an worker and earn a wage. Let’s make it the median US family revenue of $63,179.

- Below-spend your revenue and make investments 10% of your paycheck in a low-cost index fund, which is $6,300 per 12 months.

- Assume you get an inflation-adjusted annual return of seven% which is the historic common of the S&P 500.

- Do that religiously for many years and by no means cease.

Utilizing these very affordable assumptions, you’d be a millionaire in 37 years. In nominal phrases, you’d attain it even sooner as a result of that is inflation-adjusted millionaire standing.

Right here’s the desk:

| Years | Web Property | Contribution | Return |

| 0 | $0,00 | $6.300,00 | $0,00 |

| 1 | $6.300,00 | $6.300,00 | $441,00 |

| 2 | $13.041,00 | $6.300,00 | $912,87 |

| 3 | $20.253,87 | $6.300,00 | $1.417,77 |

| 4 | $27.971,64 | $6.300,00 | $1.958,01 |

| 5 | $36.229,66 | $6.300,00 | $2.536,08 |

| 6 | $45.065,73 | $6.300,00 | $3.154,60 |

| 7 | $54.520,33 | $6.300,00 | $3.816,42 |

| 8 | $64.636,76 | $6.300,00 | $4.524,57 |

| 9 | $75.461,33 | $6.300,00 | $5.282,29 |

| 10 | $87.043,62 | $6.300,00 | $6.093,05 |

| 11 | $99.436,68 | $6.300,00 | $6.960,57 |

| 12 | $112.697,24 | $6.300,00 | $7.888,81 |

| 13 | $126.886,05 | $6.300,00 | $8.882,02 |

| 14 | $142.068,07 | $6.300,00 | $9.944,77 |

| 15 | $158.312,84 | $6.300,00 | $11.081,90 |

| 16 | $175.694,74 | $6.300,00 | $12.298,63 |

| 17 | $194.293,37 | $6.300,00 | $13.600,54 |

| 18 | $214.193,90 | $6.300,00 | $14.993,57 |

| 19 | $235.487,48 | $6.300,00 | $16.484,12 |

| 20 | $258.271,60 | $6.300,00 | $18.079,01 |

| 21 | $282.650,61 | $6.300,00 | $19.785,54 |

| 22 | $308.736,16 | $6.300,00 | $21.611,53 |

| 23 | $336.647,69 | $6.300,00 | $23.565,34 |

| 24 | $366.513,03 | $6.300,00 | $25.655,91 |

| 25 | $398.468,94 | $6.300,00 | $27.892,83 |

| 26 | $432.661,76 | $6.300,00 | $30.286,32 |

| 27 | $469.248,09 | $6.300,00 | $32.847,37 |

| 28 | $508.395,45 | $6.300,00 | $35.587,68 |

| 29 | $550.283,13 | $6.300,00 | $38.519,82 |

| 30 | $595.102,95 | $6.300,00 | $41.657,21 |

| 31 | $643.060,16 | $6.300,00 | $45.014,21 |

| 32 | $694.374,37 | $6.300,00 | $48.606,21 |

| 33 | $749.280,58 | $6.300,00 | $52.449,64 |

| 34 | $808.030,22 | $6.300,00 | $56.562,12 |

| 35 | $870.892,33 | $6.300,00 | $60.962,46 |

| 36 | $938.154,80 | $6.300,00 | $65.670,84 |

| 37 | $1.010.125,63 ? | $6.300,00 | $70.708,79 |

So should you observe these easy steps beginning with the age of 30, you’ll be able to count on to be a millionaire in 37 years at age 67.

However are you able to do even higher? Let’s discover out!

Don’t-Be-So-Lazy Technique

The beforehand mentioned assumptions are very lazy.

They assume your median revenue by no means grows as you mature. It additionally assumes median revenue and never common revenue. It assumes you’ll stay a mean individual all of your life and also you’re not prepared to learn greater than a technical ebook a decade. It additionally assumes you don’t improve your financial savings charge as you earn extra.

Much more, you’ll be able to count on your revenue to extend with inflation so the nominal quantity you add to your nest egg will improve as properly with out you even needing to avoid wasting extra.

- Begin with a median revenue of $63,197.

- Assume your revenue grows by a modest 3% per 12 months as you mature and grow to be extra precious to {the marketplace}. You will be extra aggressive however let’s make it not too onerous for now. We assume your revenue progress stops as quickly as you’ve reached the six-figure revenue mark. This makes it much more practical, doesn’t it?

- Begin investing 10% of your paycheck however develop your financial savings charge by 1% per 12 months. That is lower than your wage progress!

- The identical common annualized return of funding charge of seven%, the inflation-adjusted common of S&P 500.

Right here’s how the chart appears like on this case:

Let’s take a look at the desk that has grow to be considerably shorter! In simply 25 years, you’d be a millionaire!

| Years | Web Property | Revenue | Financial savings Price | Contribution | Return |

| 0 | $0,00 | $63.197,00 | 10,00% | $6.319,70 | $0,00 |

| 1 | $6.319,70 | $65.092,91 | 11,00% | $7.160,22 | $442,38 |

| 2 | $13.922,30 | $67.045,70 | 12,00% | $8.045,48 | $974,56 |

| 3 | $22.942,34 | $69.057,07 | 13,00% | $8.977,42 | $1.605,96 |

| 4 | $33.525,73 | $71.128,78 | 14,00% | $9.958,03 | $2.346,80 |

| 5 | $45.830,56 | $73.262,64 | 15,00% | $10.989,40 | $3.208,14 |

| 6 | $60.028,09 | $75.460,52 | 16,00% | $12.073,68 | $4.201,97 |

| 7 | $76.303,74 | $77.724,34 | 17,00% | $13.213,14 | $5.341,26 |

| 8 | $94.858,14 | $80.056,07 | 18,00% | $14.410,09 | $6.640,07 |

| 9 | $115.908,30 | $82.457,75 | 19,00% | $15.666,97 | $8.113,58 |

| 10 | $139.688,86 | $84.931,48 | 20,00% | $16.986,30 | $9.778,22 |

| 11 | $166.453,38 | $87.479,43 | 21,00% | $18.370,68 | $11.651,74 |

| 12 | $196.475,79 | $90.103,81 | 22,00% | $19.822,84 | $13.753,31 |

| 13 | $230.051,93 | $92.806,93 | 23,00% | $21.345,59 | $16.103,64 |

| 14 | $267.501,16 | $95.591,13 | 24,00% | $22.941,87 | $18.725,08 |

| 15 | $309.168,12 | $98.458,87 | 25,00% | $24.614,72 | $21.641,77 |

| 16 | $355.424,60 | $101.412,63 | 26,00% | $26.367,28 | $24.879,72 |

| 17 | $406.671,61 | $101.412,63 | 27,00% | $27.381,41 | $28.467,01 |

| 18 | $462.520,03 | $101.412,63 | 28,00% | $28.395,54 | $32.376,40 |

| 19 | $523.291,97 | $101.412,63 | 29,00% | $29.409,66 | $36.630,44 |

| 20 | $589.332,07 | $101.412,63 | 30,00% | $30.423,79 | $41.253,25 |

| 21 | $661.009,11 | $101.412,63 | 31,00% | $31.437,92 | $46.270,64 |

| 22 | $738.717,66 | $101.412,63 | 32,00% | $32.452,04 | $51.710,24 |

| 23 | $822.879,94 | $101.412,63 | 33,00% | $33.466,17 | $57.601,60 |

| 24 | $913.947,70 | $101.412,63 | 34,00% | $34.480,30 | $63.976,34 |

| 25 | $1.012.404,34 | $101.412,63 | 35,00% | $35.494,42 | $70.868,30 |

The double-flank assault of accelerating your financial savings charge and your revenue modestly accelerates your journey to millionaire standing considerably from 37 years to 25 years.

So, should you begin at age 30, you’d be a millionaire at age 55!

However are you able to do even higher?

Save-Extra Technique

Say, you begin with an aggressive 20% financial savings charge straight away—and also you put money into small-cap worth index funds that expectedly yield 1% greater than the S&P 500.

- Begin with a median revenue of $63,197.

- Assume your revenue grows by a modest 3% per 12 months as you mature and grow to be extra precious to {the marketplace}.

- We assume your revenue progress stops as quickly as you’ve reached the six-figure revenue mark.

- Begin investing 20% of your paycheck however develop your financial savings charge by 1% per 12 months. That is lower than your wage progress!

- A mean annualized return of funding charge of 8%, the inflation-adjusted common of S&P 500 plus 1% premium for small-cap worth shares.

Right here’s the graph:

And the desk:

| Years | Web Property | Revenue | Financial savings Price | Contribution | Return |

| 0 | $0,00 | $63.197,00 | 20,00% | $12.639,40 | $0,00 |

| 1 | $12.639,40 | $65.092,91 | 21,00% | $13.669,51 | $1.011,15 |

| 2 | $27.320,06 | $67.045,70 | 22,00% | $14.750,05 | $2.185,61 |

| 3 | $44.255,72 | $69.057,07 | 23,00% | $15.883,13 | $3.540,46 |

| 4 | $63.679,30 | $71.128,78 | 24,00% | $17.070,91 | $5.094,34 |

| 5 | $85.844,56 | $73.262,64 | 25,00% | $18.315,66 | $6.867,56 |

| 6 | $111.027,78 | $75.460,52 | 26,00% | $19.619,74 | $8.882,22 |

| 7 | $139.529,74 | $77.724,34 | 27,00% | $20.985,57 | $11.162,38 |

| 8 | $171.677,69 | $80.056,07 | 28,00% | $22.415,70 | $13.734,22 |

| 9 | $207.827,61 | $82.457,75 | 29,00% | $23.912,75 | $16.626,21 |

| 10 | $248.366,56 | $84.931,48 | 30,00% | $25.479,45 | $19.869,32 |

| 11 | $293.715,33 | $87.479,43 | 31,00% | $27.118,62 | $23.497,23 |

| 12 | $344.331,18 | $90.103,81 | 32,00% | $28.833,22 | $27.546,49 |

| 13 | $400.710,90 | $92.806,93 | 33,00% | $30.626,29 | $32.056,87 |

| 14 | $463.394,05 | $95.591,13 | 34,00% | $32.500,99 | $37.071,52 |

| 15 | $532.966,56 | $98.458,87 | 35,00% | $34.460,60 | $42.637,32 |

| 16 | $610.064,49 | $101.412,63 | 36,00% | $36.508,55 | $48.805,16 |

| 17 | $695.378,20 | $101.412,63 | 37,00% | $37.522,67 | $55.630,26 |

| 18 | $788.531,13 | $101.412,63 | 38,00% | $38.536,80 | $63.082,49 |

| 19 | $890.150,42 | $101.412,63 | 39,00% | $39.550,93 | $71.212,03 |

| 20 | $1.000.913,38 ? | $101.412,63 | 40,00% | $40.565,05 | $80.073,07 |

An aggressive 20% financial savings charge to start out with mixed with an funding in small-cap worth index funds can speed up your reaching millionaire standing to twenty years.

Facet-Enterprise Technique

Till now, we’ve assumed you stay employed and also you don’t do something on the facet. Nonetheless, the world is crammed with alternatives and you may simply construct a facet enterprise whereas working in your primary job.

Making a enterprise is the final word solution to riches. As an alternative of solely shopping for different individuals’s companies by way of the inventory market, you now grow to be a enterprise proprietor your self constructing your individual second revenue stream slowly and steadily.

All the opposite assumptions stay the identical.

- Begin with a median revenue of $63,197.

- Assume your revenue grows by a modest 3% per 12 months as you mature and grow to be extra precious to {the marketplace}.

- We assume your revenue progress stops as quickly as you’ve reached the six-figure revenue mark. This makes it much more practical, doesn’t it?

- Begin investing 20% of your paycheck however develop your financial savings charge by 1% per 12 months. That is lower than your wage progress!

- A mean annualized return of funding charge of 8%, the inflation-adjusted common of S&P 500 plus 1% premium for small-cap worth shares.

- Construct a facet enterprise that earns $12,000 within the first 12 months and grows by 20% every year.

- We worth the facet enterprise at a value/earnings ratio of 5 which could be very conservative evaluating it to the inventory market’s common P/E a number of of 20.

Right here’s the chart:

After solely 13 years, you’d be a millionaire below these assumptions. You’ll find the detailed desk right here:

| Years | Inventory Market Property | Revenue | Financial savings Price | Contribution | ROI | Enterprise Earnings | Valuation | Web Price |

| 0 | $0,00 | $63.197,00 | 20,00% | $12.639,40 | $0,00 | $12.000,00 | $60.000,00 | $60.000,00 |

| 1 | $12.639,40 | $65.092,91 | 21,00% | $13.669,51 | $1.011,15 | $14.400,00 | $72.000,00 | $84.639,40 |

| 2 | $27.320,06 | $67.045,70 | 22,00% | $14.750,05 | $2.185,61 | $17.280,00 | $86.400,00 | $113.720,06 |

| 3 | $44.255,72 | $69.057,07 | 23,00% | $15.883,13 | $3.540,46 | $20.736,00 | $103.680,00 | $147.935,72 |

| 4 | $63.679,30 | $71.128,78 | 24,00% | $17.070,91 | $5.094,34 | $24.883,20 | $124.416,00 | $188.095,30 |

| 5 | $85.844,56 | $73.262,64 | 25,00% | $18.315,66 | $6.867,56 | $29.859,84 | $149.299,20 | $235.143,76 |

| 6 | $111.027,78 | $75.460,52 | 26,00% | $19.619,74 | $8.882,22 | $35.831,81 | $179.159,04 | $290.186,82 |

| 7 | $139.529,74 | $77.724,34 | 27,00% | $20.985,57 | $11.162,38 | $42.998,17 | $214.990,85 | $354.520,59 |

| 8 | $171.677,69 | $80.056,07 | 28,00% | $22.415,70 | $13.734,22 | $51.597,80 | $257.989,02 | $429.666,71 |

| 9 | $207.827,61 | $82.457,75 | 29,00% | $23.912,75 | $16.626,21 | $61.917,36 | $309.586,82 | $517.414,43 |

| 10 | $248.366,56 | $84.931,48 | 30,00% | $25.479,45 | $19.869,32 | $74.300,84 | $371.504,19 | $619.870,75 |

| 11 | $293.715,33 | $87.479,43 | 31,00% | $27.118,62 | $23.497,23 | $89.161,00 | $445.805,02 | $739.520,35 |

| 12 | $344.331,18 | $90.103,81 | 32,00% | $28.833,22 | $27.546,49 | $106.993,21 | $534.966,03 | $879.297,21 |

| 13 | $400.710,90 | $92.806,93 | 33,00% | $30.626,29 | $32.056,87 | $128.391,85 | $641.959,23 | $1.042.670,13 ? |

In the event you surprise how one can construct a rising facet enterprise, there are such a lot of alternatives:

- Turning into a freelancer.

- Creating your individual web site.

- Collaborate with different enterprise homeowners or content material creators to create info merchandise.

- Do some actual property.

You possibly can study extra about learn how to grow to be a contract developer and scale your on-line coding startup within the detailed Finxter freelancer course.

*** [Course] Create Your Coding Enterprise On-line ***

There are Many Methods to Millionaire Standing

Don’t fear should you didn’t just like the earlier means of making a facet enterprise. There are such a lot of alternative ways. Simply do your individual math, and dream your individual goals. Construct upon the essential plan that takes you 37 years and check out wild concepts. Then select what fits you greatest.

You possibly can take a look at the spreadsheets used on this article right here:

Create your individual millionaire math!

Bonus: The Frugal Investor Technique

Say, you don’t wish to study and enhance in your job. As an alternative, you do the naked minimal to your job, and don’t develop your revenue, however you make investments the free time sources to review your individual inventory or actual property investments.

Warren Buffett remodeled 30% on very small sums of cash. Say, you make 15% per 12 months focusing your vitality and willingness to study to take a position.

- Frugal way of life or cowl bills in any other case: save 50% of your paycheck.

- Investing vitality: Obtain a 15% yield in your funding by inventory market analysis, crypto, or actual property leverage.

Right here’s the graph:

Below these assumptions, you’d be a millionaire in 13 years.

And right here’s the desk:

| Years | Web Price | Revenue | Financial savings Price | Contribution | ROI |

| 0 | $0,00 | $63.197,00 | 50,00% | $31.598,50 | $0,00 |

| 1 | $31.598,50 | $63.197,00 | 50,00% | $31.598,50 | $4.739,78 |

| 2 | $67.936,78 | $63.197,00 | 50,00% | $31.598,50 | $10.190,52 |

| 3 | $109.725,79 | $63.197,00 | 50,00% | $31.598,50 | $16.458,87 |

| 4 | $157.783,16 | $63.197,00 | 50,00% | $31.598,50 | $23.667,47 |

| 5 | $213.049,13 | $63.197,00 | 50,00% | $31.598,50 | $31.957,37 |

| 6 | $276.605,00 | $63.197,00 | 50,00% | $31.598,50 | $41.490,75 |

| 7 | $349.694,25 | $63.197,00 | 50,00% | $31.598,50 | $52.454,14 |

| 8 | $433.746,89 | $63.197,00 | 50,00% | $31.598,50 | $65.062,03 |

| 9 | $530.407,43 | $63.197,00 | 50,00% | $31.598,50 | $79.561,11 |

| 10 | $641.567,04 | $63.197,00 | 50,00% | $31.598,50 | $96.235,06 |

| 11 | $769.400,60 | $63.197,00 | 50,00% | $31.598,50 | $115.410,09 |

| 12 | $916.409,19 | $63.197,00 | 50,00% | $31.598,50 | $137.461,38 |

| 13 | $1.085.469,06 ? | $63.197,00 | 50,00% | $31.598,50 | $162.820,36 |

Conclusions

There are numerous methods to riches:

- 37 years to millionaire – Base technique

- 25 years to millionaire – Don’t be so lazy technique

- 20 years to millionaire – Save extra technique

- 13 years to millionaire – Facet enterprise technique

- 13 years to millionaire – Frugal investor technique

Disclaimer: I’m not an funding advisor or monetary planner. I’m not affiliated with any web site or hyperlink talked about within the article. I’m only a coder who has constructed his personal scalable enterprise on-line.

Programmer Humor

Q: What's the object-oriented solution to grow to be rich?

💰

A: Inheritance.